Executive summary and key research

Reinvent Fire: Change Energy Use Forever

Reinventing Fire: Bold Business Solutions for the New Energy Era offers market-based, actionable solutions integrating transportation, buildings, industry, and electricity.

Digging up and burning the deposits of ancient sunlight stored eons ago in primeval swamps has transformed human existence and made industrial and urban civilization possible. But fossil fuels are no longer the only, best, or even cheapest way to sustain and expand the global economy—whether or not we count fossil fuels’ hidden costs.

Tens of billions of taxpayer dollars each year subsidize America’s fossil fuels, and even more flow to the systems that burn those fuels, distorting market choices by making the fuels look far cheaper than they really are. But the biggest hidden costs are economic and military.

America’s seemingly two-billion-dollar-a-day oil habit actually costs upwards of three times that much—six billion dollars a day, or a sixth of GDP. That’s due to three kinds of hidden costs, each about a half-trillion dollars per year: the macroeconomic costs of oil dependence, the microeconomic costs of oil-price volatility, and the military costs of forces whose primary mission is intervention in the Persian Gulf. Those military costs are about ten times what we pay to buy oil from the Persian Gulf, and rival total defense spending at the height of the Cold War.

Any costs to health, safety, environment, security of energy supply, world stability and peace, or national independence or reputation are extra. Coal, too, has hidden costs, chiefly to health, of about $180–530 billion per year, and natural gas had lesser but nontrivial externalities even before shale-gas “fracking” emerged.

All fossil fuels, to varying degrees, also incur climate risks that society’s leading professional risk managers—reinsurers and the military—warn will cost us dearly. And even if fossil fuels had no hidden costs, they are all finite, with extraction peaking typically in this generation. Yet “peak oil” is now emerging in demand before supply. Thus industrialized countries’ total oil use peaked in 2005, U.S. gasoline use in 2007. Even U.S. coal use peaked in 2005, and in 2005–10, coal lost 12% of its share of U.S. electrical services (95% of its market) to natural gas, efficiency, and renewables. This is not because these fuels’ hidden costs have been properly internalized yet into their market prices, but rather because those market prices today are too high and volatile to sustain sales against rising competition.

Making a dollar of U.S. GDP in 2009 took 60% less oil, 50% less energy, 63% less directly burned natural gas, and 20% less electricity than it did in 1975, because more efficient use and alternative supplies have become cheaper and better than the fossil fuels they’ve displaced. Yet wringing far more work from our energy is only getting started, and is becoming an ever bigger and cheaper resource, because its technologies, designs, and delivery methods are improving faster than they’re so far being adopted.

Many other countries have lately pulled ahead of the United States in capturing the burgeoning potential for greater energy productivity and more durable and benign supplies. During 1980–2009, for example, the Danish economy grew by two-thirds, while energy use returned to its 1980 level and carbon emissions fell 21%. Now the conservative Danish government has adopted a virtually self-financing strategy to get completely off fossil fuels by 2050 by further boosting efficiency and switching to renewables (already 36% of electric generation, which is the most reliable and among the cheapest pretax in Europe). Why? To strengthen Denmark’s economy and national security. Europe as a whole is going in the same direction, led by Germany, and now Japan and China are moving that way. What could the U.S. do?

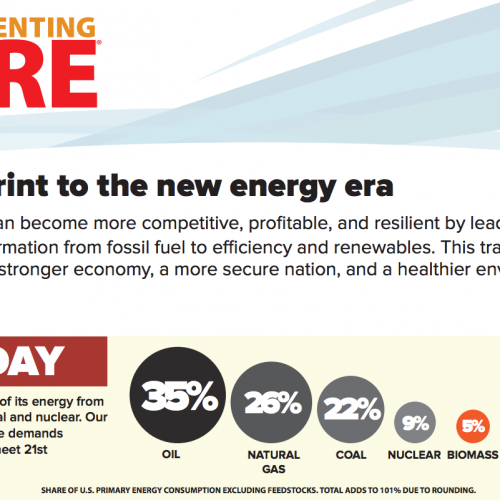

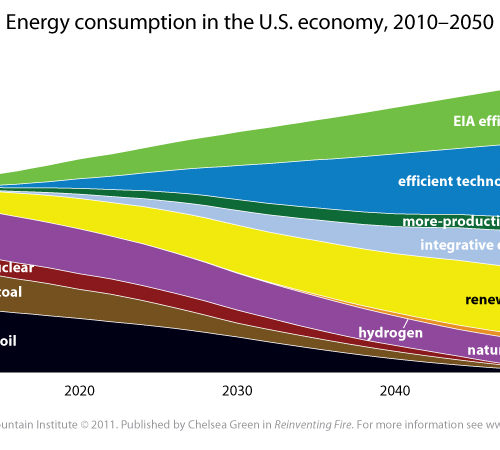

In 2010, the United States (excluding noncombustion uses as raw materials) used 93 quadrillion BTU of primary energy, four-fifths of it fossil fuels. Official projections show this growing to 117 quads in 2050. But delivering those same services with less energy, more productively used, could shrink 2050 usage to 71 quads, eliminate the need for oil, coal, nuclear energy, and one-third of the natural gas, and save $5 trillion in net-present-valued cost. As a better-than-free byproduct of efficient use and a continued shift to renewable supplies, fossil carbon emissions would also shrink by 82–86% below their 2000 levels despite the assumed 2.58-fold bigger economy than in 2010.

Natural gas saved through more-efficient buildings and factories could be reallocated to cleaner, cheaper, and more efficient combined-heat-and-power in industry (though we conservatively assume none in buildings), to displacing oil and coal in buildings and factories, and optionally to fueling trucks. America’s energy supply in 2050 would end up roughly three-fourths renewable and one-fourth natural gas (the same fraction as in 2010, but of a smaller total—one-fourth less primary energy and one-third less delivered energy). The remaining gas use, which is probably conservatively high, could phase out over a few decades after 2050. Meanwhile, the United States could take advantage of new shale-gas resources if their many uncertainties turned out well, but not be caught short if they didn’t. Biomass would supply about six times more energy in 2050 than in 2010—two-thirds from waste streams (chiefly in industry) and one-third from cellulosic and algal feedstocks whose production wouldn’t interfere with food production nor harm soil or climate. Liquid biofuels needed for transportation would be equivalent to less than one-sixth today’s total U.S. oil consumption.

To shrink U.S. energy use while GDP grows 158% is not a fantasy; in nine of the 36 years through 2009, the U.S. economy actually did raise energy productivity faster than GDP grew. Chapters 2–5 show how to do that every year, with major competitive, security, health, and environmental advantages, simply by using energy in a way that saves money, modulating demand unobtrusively over time to match energy’s real-time value, and optimizing supply from the cheapest, least-risky sources. This transition won’t be easy, but will be easier than not doing it. It is already underway, driven inexorably by innovation, competition, and customer preferences. Just as whale-oil suppliers ran out of customers in the 1850s before they ran out of whales, oil and coal are becoming uncompetitive even at low prices before they be come unavailable even at high prices. It’s about $5 trillion cheaper, and smarter in other ways, not to keep on burning them, even if their hidden costs were worth zero.

Realizing this potential does not require business to take a hit or suffer a loss. On the contrary, Reinventing Fire applies normal rate-of-return requirements in each sector, so each proposed change must earn at least a 12%/y real return in industry, 7% in buildings, and 5.7% in electricity, and new autos must repay any higher price within three years. Actually, the suggested investment portfolio considerably outperforms these hurdle rates: the Reinventing Fire strategy would achieve Internal Rates of Return averaging 33% in buildings, 21% in industry, 17% in transportation, and 14% across all sectors—including making the entire electricity system clean, secure, reliable, resilient, flexible, and at least 80% renewable. These are among the highest and least-risky returns in the whole economy.

This transition won’t be easy, but will be easier than not doing it. It is already underway, driven inexorably by innovation, competition, and customer preferences. Just as whale-oil suppliers ran out of customers in the 1850s before they ran out of whales, oil and coal are becoming uncompetitive even at low prices before they be come unavailable even at high prices.

‐Amory Lovins, RMI Cofounder and Chief Scientist

Overall, a $4.5-trillion extra investment would save $9.5 trillion, for a 2010-net-present-valued saving of $5 trillion during 2010–2050, and many key risks to individual business sectors, the whole economy, and national security would be mitigated or altogether abated. Counting the important hidden benefits and costs (to health, productivity, security, etc.) not included in these figures would make the economic case even stronger. And this economic analysis doesn’t count the perhaps decisive gains to be won from more competitive business sectors (such as automaking), healthier people, and a safer, fairer, richer world. The notion that U.S. competitiveness depends on cheap, or cheap-appearing, energy wastefully used is a myth, contradicted by both economic theory and global observation. This misconception grievously shortchanges today’s unique opportunity to harness American innovation and reassert national leadership, aspirations, reputation, and influence.

The net effect of the Reinventing Fire transition on jobs would be at worst neutral and probably significantly positive, again without counting potentially dominant gains in competitive advantage that could stabilize or reverse the decline of some major U.S. industries. Net-job analyses in transportation, buildings, industry, and electricity reveal much uncertainty and complexity, but clearly, getting off oil and coal would harm neither the economy nor employment, and would probably benefit both very substantially. This fits the latest data in the marketplace: more Americans now work in renewable energy installation or in energy efficiency installation than in the entire coal industry, for example. Those new jobs, too, are widely distributed by occupation and location, are durable, and can’t be moved offshore. Countries with more coherent transitional policies are already further ahead. Denmark’s relative economic health is substantially driven by its world-class energy-technology exports (chiefly windpower) and its lower energy imports and costs. Germany, which has staked its energy future on an efficiency-and-renewables transition, already has fuller employment than it did before the Great Recession. In essence, Germany pays its own engineers, manufacturers, and installers rather than buying natural gas from Russia, and that investment shift is already paying off.

Failure to shift to efficiency and renewables also gravely harms national security—by spreading rather than limiting nuclear weapons, creating rather than removing attractive terrorist targets, exacerbating rather than relieving global poverty and inequity, fueling rather than soothing global tensions and instabilities, and sending military forces on more and riskier missions rather than fewer and safer.

Incumbent industries that extract, supply, and use fossil fuels are a major force. They must adapt to these new conditions and requirements just as they always have to many kinds of change. But change need not harm their strategic prospects. Hydrocarbons are generally worth more as a source of hydrogen and organic molecules than as a fuel. Hydrocarbon and electricity companies have important assets, capabilities, and skills whose judicious deployment will be vital to a successful energy transition. Moving beyond oil and coal can harness those advan tages in ways that sustain profits, diversify options, and manage risks. The firms that do this first should beat the laggards. This is not merely a matter of normal domestic industrial evolution but of global revolution, because extraordinary competition from abroad—most of all from China and Europe, but rapidly spreading around the globe—leaves American industries little choice. They can catch up and pull ahead or they can fall behind, losing the greatest business opportunity in this and perhaps any age, and locking in long-term dependence on key foreign technologies—many first developed in the United States—the same sort of debilitating economic hemor rhage that America’s oil dependence creates today. But encouragingly, much of the innovation and rapid scale-up now occurring worldwide is coming from the global South, driving economic development that can help make people everywhere healthier, happier, richer, and more peaceful.

The key barrier to success is not inadequate technologies but tardy adoption. The rate of implementation required to reach Reinventing Fire’s ambitious goals is challenging but manageable—just as it was in 1977–85, when the U.S. cut its oil intensity at an average rate of 5.2%/y. Our analysis assumes that on average, the entire United States will ramp up over decades to the rates of efficiency and renew ables adoption that the most attentive states have already achieved. Whatever exists is possible. What’s needed is a coherent and compelling vision, leadership at all levels (but not necessarily from Congress, whose action is not actually required for Reinventing Fire), and the courage to capture the opportunities now before each of us. Their value, feasibility, and practical uptake can thrive in our immensely diverse and politically fractious society if we focus on outcomes, not motives—if we simply do what makes sense and makes money, without having to agree on why it’s important. In a nation tired of gridlock, this transideological attractiveness and practicality is good news. Whether we most care about economy, security, or health and environment, Reinventing Fire is spherically sensible—it makes sense no matter which way around you view it.

Executive Summaries

Executive summary and key research

Executive summary and key research

Executive summary and key research

Methodologies

Analytic methodologies used in Reinventing Fire, as well as the scope, limitations, and intended audience of the book.

Methodology for the analysis of the transportation sector in Reinventing Fire.

Methodology for the analysis of the buildings sector in Reinventing Fire.

Methodology for the analysis of the industry sector in Reinventing Fire.

Overview of Reinventing Fire’s electricity sector analysis with a focus on the methodologies and inputs of NREL’s ReEDS and RMI’s dispatch model.

Reinventing Fire integration model methodology.

Reinventing Fire jobs model methodology.

Methodology for figure 1-3 in Reinventing Fire.

Resources

2011

2011

2017

2016

Purchase the book

Reinventing Fire is available in four languages and in paperback and digital versions.